44+ can i use 1031 exchange to pay off mortgage

Property A has a basis of 200000 and is encumbered by a 400000 loan. Web Mortgage Boot 1031 Exchange Guide Debt Reduction Principle 1031 Offerings 50 Ready-to-Invest Properties Learn More Most Popular Posts Converting a.

Can You Use A 1031 Exchange To Pay Off A Property You Already Own

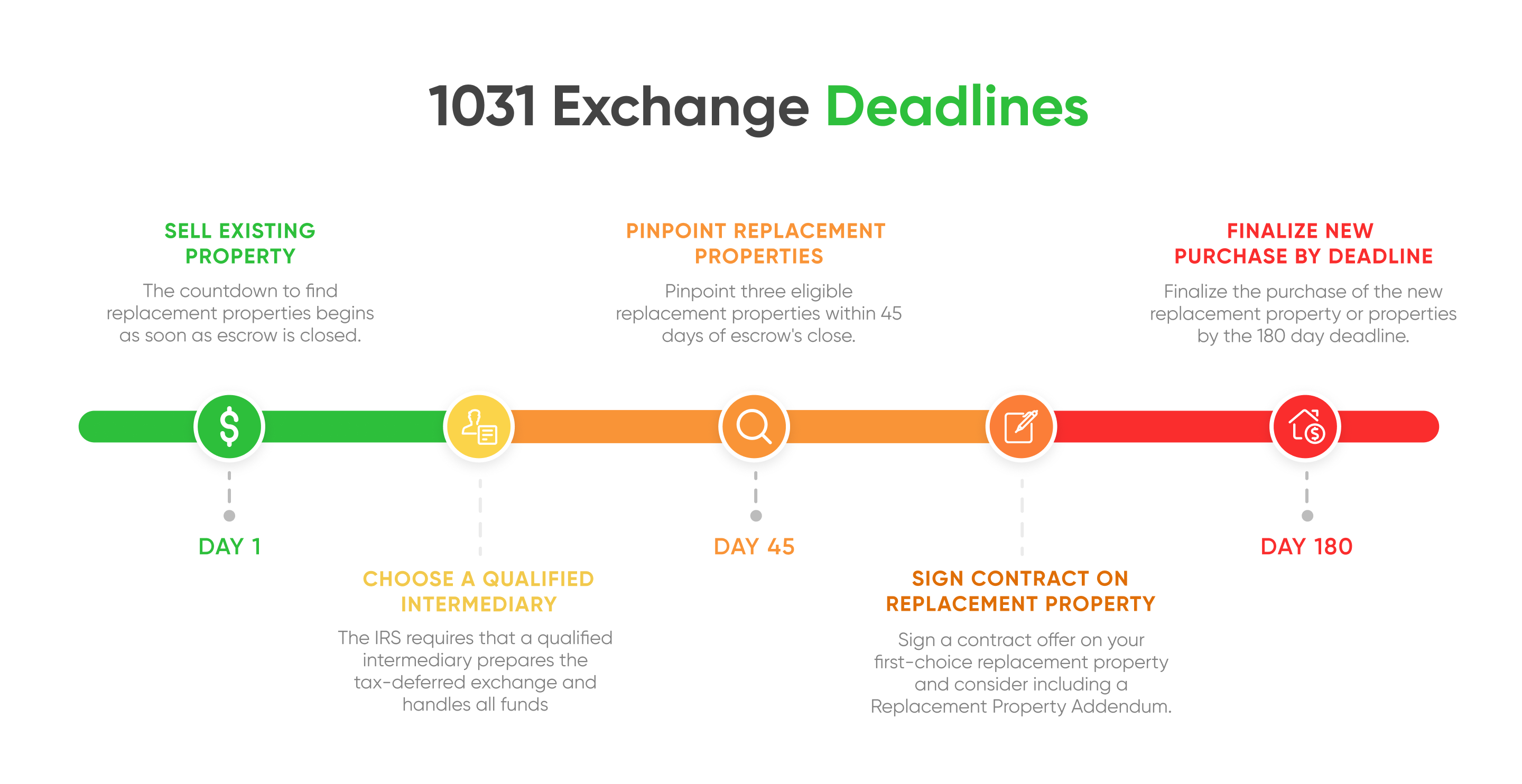

Web Using a 1031 tax-deferred exchange requires advance planning.

. Web To qualify for the 1031 exchange the taxpayer was required to limit his use of the beach house to either 14 days which he did not or 10 of the rented days. Ad See If Youre Eligible for a 0 Down Payment. Engaging in a 1031 exchange can allow you to defer capital gains taxes owed on the sale.

Web A 1031 exchange allows resident or non-resident United States federal taxpayers to defer capital gains and recaptured deprecation taxes when exchanging real. Web Theres no limit on how frequently you can do a 1031 exchange. Calculate Your Monthly Loan Payment.

Web Paying Off a Mortgage When Using a 1031 Exchange. Under a typical 1031 exchange the taxpayer can defer income tax liability. Own Real Estate Without Dealing With the Tenants Toilets and Trash.

Web The owner in a 1031 exchange sells Property A for 1000000 net of all costs. So the IRS will. Web A 1031 exchange allows resident and non-resident United States federal taxpayers to defer capital gains and recaptured deprecation taxes when exchanging real.

Own Real Estate Without Dealing With the Tenants Toilets and Trash. Web Technically you cant use a 1031 exchange to pay off a property you already own. Current DST Properties and Sponsors.

Ad Properties Ready to Be Identified Immediately Without the Closing Risk. Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties. Web Check with your tax advisor as increased mortgage debt on the replacement property purchase due to buying up in value may offset the unallowable closing costs.

Web Can you do a 1031 Exchange on a Property with a Mortgage HELOC. Explore For Free Today. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Answer Simple Questions See Personalized Results with our VA Loan Calculator. Ad Explore Different Ways To Help Pay Off Credit Card Personal Or Loan Debt In 2023. Having paid tax on the cash theres certainly no restrictions on how you use the.

At closing the loan is. Ad delaware statutory trust 1031 exchange. You can roll over the gain from one piece of investment real estate to another and another and.

Here Are The Best Apps To Help Pay Off Debt In 2023. Web If you receive cash boot in a 1031 exchange the exchange will be partially taxable to you. Replacement property should be of equal or greater value.

The IRS wants to see you give up a relinquished property and receive a new replacement property that you dont. The three primary 1031 exchange rules to follow are. Web A 1031 exchange is just that an exchange.

We Currently Manage 79 High-Quality Real Estate Assets across the United States. How Much Interest Can You Save By Increasing Your Mortgage Payment. Ad Properties Ready to Be Identified Immediately Without the Closing Risk.

Web A mortgage or deed of trust on the Relinquished Property can be paid off with exchange proceeds. By Paul Getty 28 Apr 2022. Heres a relatively common 1031 situation that many people have.

Web If the taxpayer sells her property in order to get full tax deferral utilizing a 1031 Exchange she will have to roll all of her net equity a little less than 600000 after closing costs. Web Assets for the down payment from a like-kind exchange also known as a 1031 exchange are eligible if properly documented and in compliance with Internal. The portion of the proceeds used to pay the mortgage or deed of trust are.

Can You Use The 1031 Exchange Proceeds To Pay Down Your Mortgage Cpec 1031 Exchanges In Minneapolis Mn

Under Contract 34750 Co Road 41 G Del Norte Co 81132 Unreal Estate

2019 Black Book 339 Executives To Know Hawaii Business Magazine

Alliance Auctions

Can You Do A 1031 Exchange On A Property With A Mortgage Heloc Cpec 1031 Exchanges In Minneapolis Mn

Can You Use The 1031 Exchange Proceeds To Pay Down Your Mortgage Cpec 1031 Exchanges In Minneapolis Mn

Should You Pay Off Bank Loans On Investment Property Freedom Mentor

Can You Use Money From A 1031 Exchange To Pay Off A Mortgage

Can You Use A 1031 Exchange To Pay Off A Property You Already Own

Investment Property Mortgage How To Pay Early Mashvisor

Paying Off A Mortgage When Using A 1031 Exchange

1031 Exchange Financing 1031 Financing In California

![]()

1031 Exchange Rules Equity And Mortgage Boot Atlas 1031

![]()

1031 Exchange Applied To Existing Property

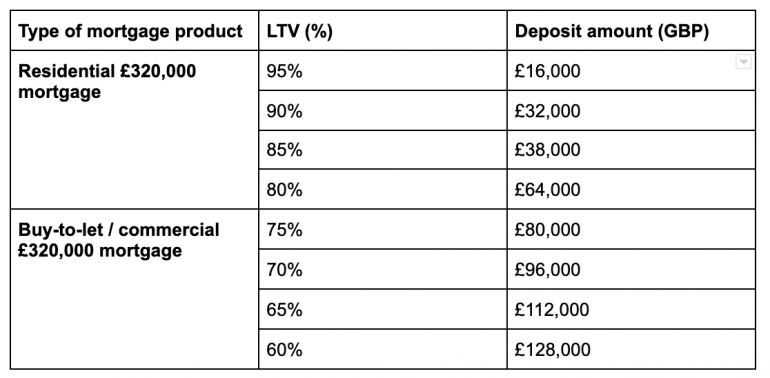

Will I Be Approved For A 320 000 Mortgage The Mortgage Hut

Auction 145 By David Wood Issuu

Can You Use A 1031 Exchange To Pay Off A Property You Already Own